Throughout this article we will look at how naming rights sponsorship has an impact among NHL teams by analyzing Twitter affinity data through Zoomph. We will see which teams have the best/worst partnerships, the best sectors for general affinity among NHL fans, and some interesting insights found from analyzing the data.

Explanation of Terms

Hardcore NHL Fans = Twitter followers that have been identified as having an interest in hockey + follow the official NHL Twitter account.

Hardcore X Team Fans = Twitter followers that use keywords (ex: “Preds” for the Nashville Predators) and follow X team’s official account.

Affinity = The amount of people that follow a certain brand as compared to the population.

Hardcore NHL Fans Affinity = The amount of people that follow X brand divided by the amount of hardcore NHL fans.

Hardcore X Teams Affinity = The amount of people that follow X brand divided by the amount of hardcore X teams fans.

Hardcore NHL Fans Indexed (Affinity) = Hardcore NHL Fans Affinity divided by Hardcore X Teams Affinity.

Hardcore X Teams Indexed (Affinity) = Hardcore X Teams Affinity divided by Hardcore NHL Fans Affinity.

Spread = The difference between:

Hardcore X Teams Indexed Affinity for the naming rights sponsor divided by the Hardcore NHL Fans Indexed Affinity for the naming rights sponsor

And

Hardcore X Teams Indexed Affinity for the naming rights sponsors competitor’s average divided by the Hardcore NHL Fans Indexed Affinity for the naming rights sponsors competitor’s average.

Now that we have that behind us, it’s time for the puck drop.

Top 5 - Best Partnerships by Spread

To simplify spread – the spread is what total value the naming rights sponsor has gained from the partnership (a.k.a. the difference in what the affinity is now vs. what the affinity would have been if there was no partnership in place).

Arizona Coyotes - Gila River Casinos

First, daylights savings time, and now Gila River Casinos performs best in spread among any NHL naming rights partner. Arizona is always winning, except on the ice (sorry Coyotes fans, I miss Mike Smith in his prime too). Gila River has a tremendous, indexed affinity among Coyotes fans due to them being a local casino found only in Arizona. This spread is made smaller due to Coyotes fans having a 50x affinity for competitors of the same nature (found only in Arizona) compared to NHL fans in general. While this massive increase in affinity for competitors is remarkable, it is overshadowed by Coyotes fans having 180x the affinity for Gila River than NHL fans, which solidifies Gila River’s place at the top of the standings in spread.

Pittsburgh Penguins – PPG Paints

PPG, founded as Pittsburgh Plate Glass in the late 1800s, has deep roots in the steel city. PPG has been the naming rights partner since 2016 and has a very high affinity among Penguins fans (1.77%). This is almost a 15 times higher affinity than NHL fans have for the brand. The closest competitor to PPG is Sherwin-Williams with roughly 1/6th of the affinity (.3%) than Penguins fans have for PPG. Penguins fans have roughly 25% less affinity for PPG’s competitors (.12% average) compared to the NHL fans (.16% average). This combination of low affinity for competitors and extremely high affinity for PPG makes for the second highest spread among NHL teams.

Columbus Blue Jackets – Nationwide

Since the arena’s inception in 2000, Columbus-based insurance provider Nationwide has been the Blue Jackets sponsor. Interestingly, Nationwide is also majority owner of the Blue Jackets. Both of these examples would explain why Nationwide is third-best performing in spread for NHL naming rights sponsors; not to mention that Blue Jackets fans have around 1/3rd less affinity for Nationwide’s competitors than NHL fans.

Buffalo Sabres – KeyBank

The Buffalo Sabres finished fourth best in spread among NHL teams. Their sponsorship by KeyBank is a great example how going outside of the home market for sponsorships can work in the company’s favor. KeyBank has an indexed affinity among Sabres fans of 9.43, which beats out every other team’s indexed affinity for bank naming rights partners in the NHL (ex: Wells Fargo for the Flyers at 1.1x, and PNC for the Hurricanes at 3.0x).

Nashville Predators – Bridgestone

Bridgestone, the official tire of the NHL, is also the naming rights sponsor of the Nashville Predators. This sponsorship seems to be very effective, as the Japanese manufacturer has also established a solid foundation in the Music City by building Bridgestone Tower in downtown, which is the headquarters of Bridgestone’s American operations. Bridgestone has an indexed affinity among Predators fans of 7.4x, which widens the spread tremendously. This is roughly 3 times the affinity Predators fans have for Michelin (2.3x) and 4.5 times the affinity Preds fans have for Goodyear (1.6x). The only competitor that comes close on indexed affinity is Discount Tire at 5x, which is possibly due to their sponsorship of Austin Cindric and the #2 car in the NASCAR circuit - a southern-dominated fanbase.

Bottom 5 - Worst Partnerships by Spread

Seattle Kraken – Amazon

The Seattle Kraken are the newest team in the NHL, who just started play in October. This showed when identifying hardcore fans of the team. Only 5 people were identified as hardcore fans, so the sample size was small and should be taken with a grain of salt. However, there was affinity for Amazon’s competitor Walmart among this group. I will note that their arena is an anomaly, as they do not call it Amazon Arena, but Climate Pledge Arena (a nod to Amazon’s commitment to the environment and sustainability).

Edmonton Oilers & Vancouver Canucks – Rogers

The Oilers and Canucks both have Rogers Communications as their naming rights sponsor and both teams are performing poorly. The Edmonton Oilers and their fanbase has a 2.8% affinity for Rogers and an indexed affinity of 2.5x when compared to the NHL fanbase. Vancouver Canucks fans, on the other hand, have a higher general affinity for Rogers (4.5%) and higher indexed affinity (4.1x) than do Oilers fans. This looks pretty good on the surface, however, both fanbases average affinity for Rogers’ competitors are higher than their affinity for Rogers itself (5.2% for Edmonton and 6.3% for Vancouver). This high affinity for Rogers’ competitors creates a negative 20.29 spread for the Canucks and a negative 21.72 spread for the Oilers.

Winnipeg Jets – Canada Life

The main reason why Winnipeg has one of the worst spreads in the NHL is because their partnership with Canada Life Assurance Company just began in June of 2021. NHL fans only have a small amount of affinity for the brand (.002%) and hardcore Jets fans have no affinity for the brand yet. Hardcore Jets fans roughly 3x average affinity for Canada Life’s competitors when compared to NHL fans does not help narrow the spread for the insurance provider either. This problem is one that should improve once fans get used to the new 10-year naming rights sponsor and gain more familiarity with Canada Life, who is now heavily invested in Winnipeg’s sports scene.

New York Islanders – UBS

The New York Islanders recently relocated to their new home arena from Nassau Coliseum, where they played home games and won 4 Stanley Cups since their inception in 1972. This low affinity for UBS (a Swiss-based investment bank) is understandable since the team only started playing there in November of 2021. UBS has 60% less affinity among Islanders fans compared to NHL fans in general, plus Islanders fans have an increase in general affinity for UBS’ competitors of 28%. This makes for a large spread that is being widened in both ways.

Best & Worst for General Affinity Among Hardcore NHL Fans

Division Leaders

Note: this average is of the naming rights sponsors’ competitors only.

Best (3.55%) - Wireless Carriers (American)

Naming rights sponsor of the Vegas Golden Knights, T-Mobile, had an affinity of 2.5% among NHL fans. While this is high, competitors Verizon (4.3%) and AT&T (2.8%) were even higher. This average among these 3 major American wireless brands makes for the highest average affinity among any sector for NHL fans.

2nd Best (3.4%) – Retail

The second-best performing sector in general affinity among NHL fans was the retail sector. This was seen when analyzing Amazon’s (Climate Pledge Arena) partnership with the Seattle Kraken. Roughly 7 in 100 hardcore NHL fans have an affinity for Amazon and 6 in 100 fans have an affinity for Target. This 7.2% affinity for Amazon is unmatched among any brand across all sectors.

3rd Best (2.96 % avg) – Airlines

The average affinity among competitors between the Blackhawks (United) and Stars (American) was 2.96%. The highest in general affinity among NHL fans in this sector was Southwest (6.4%) and Delta (4.4%).

Worst in the League

Besides the Casino (Arizona-based) and Canadian Insurance sector, which are very specified sectors with geographic boundaries, these below are the worst sectors by general affinity among NHL fans.

Worst (.02%) – Energy

The Minnesota Wild’s naming rights sponsor Xcel Energy had an affinity of .4%, while subsidiary Xcel of Minnesota had a jump of 4x at .16%. Their competitors on the other hand had even less average affinity at .02%. This was the lowest average of any sector among NHL fans in general.

2nd Worst (.14%) – Car Rental

St. Louis-based Enterprise Rent-A-Car has an affinity of .20% among NHL fans, only .6% lower than the highest competitor, Hertz. This low affinity is even lower for the rest of the competitors in the rental car category, with the lowest being Hertz’s subsidiary, Dollar Rent-A-Car, at .05% (around 1 in 200 people having an affinity for the brand). The average among Enterprise’s competitors was 2nd worst of any sector at .14%.

3rd Worst (.16%) – (Tie) Crypto & Paints

There was a tie for 3rd worst affinity among competitors between PPG Paints for the Pittsburgh Penguins and Crypto.com for the Los Angeles Kings. PPG had an affinity of .12% among NHL fans and their competitors had an average of .16%, with the highest being the nationally recognized brand Sherwin-Williams at .5%. Crypto.com on the other hand had 1/4th the affinity PPG did at .03% among NHL fans. Crypto.com’s competitors also had a .16% average affinity, with the highest being Coinbase - an established exchange platform - at .7% affinity.

Interesting Finds

Since the teams that have the best spread are the same teams that have the best indexed affinity, we will skip talking about indexed affinity and instead talk about some interesting nuggets of information found by analyzing this data; data which could help maximize partnerships for brands and teams alike.

M&T Bank + Buffalo Sabres

While Cleveland-based KeyBank, the naming rights sponsor of the Sabres arena has a 9.4x indexed affinity among Sabres fans; it is interesting to note that although they are not sponsors, Buffalo-based M&T Bank has an indexed affinity of 25.4x. This is a good example of a company not further saturating their home market where they already have a high affinity. Plus, they are saving millions spent on a naming rights deal that would not have much value added. Instead of spending their money where they are already well-established, M&T Bank acquired the naming rights to the home stadium of the Baltimore Ravens in the hopes of expanding brand awareness and their national footprint.

USAA Affinity

One interesting piece of information that can be seen from the analysis done was that TD, US Bank, PNC, and Ally all registered lower general affinities among NHL fans than did USAA (.5%).

I would argue that to get their name out to the public even more (ex: Chase has 1.9% affinity and Bank of America has 1.6%), they could acquire the naming rights to a smaller market, such as Carolina and the Hurricanes or Arizona and the Coyotes. Both of those naming rights contracts end within the next 2 years. One other possibility is even outside the NHL, in military friendly San Antonio for naming rights to the Spurs arena. That contract is up for bid now, as AT&T did not renew their sponsorship.

This higher affinity among NHL fans for USAA than many other national banks also begs the question: do military-oriented families have a greater affinity for the smash-mouth game of hockey? Quite likely.

Cross-Comparison

United vs. American Airlines

In terms of spread, the Stars and their naming rights sponsor American Airlines (5.82) performs better than United with the Chicago Blackhawks (1.83). American Airlines also perform better in Stars fans average general affinity for competitors (2.6%) than does United in the same category (3.21%) - an increase in affinity for United’s competitors among Blackhawks fans of around 23%. Among hardcore Stars fans, they only had more affinity for 3 airlines than did NHL fans. Those three are low-cost-leader Spirit, Fort Worth-based American Airlines and Dallas-based, Southwest. This jump in affinity among Stars fans for Southwest and Spirit were not enough to counteract their decline in affinity for airlines such as Blackhawks sponsor United, Delta and JetBlue. So, head-to-head, American Airlines wins.

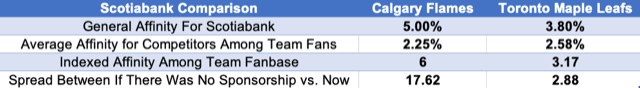

Scotiabank vs. Scotiabank

Below is the comparison of how Scotiabank’s sponsorships stack up between the Calgary Flames and Toronto Maple Leafs.

A possible explanation why Scotiabank may have a lower affinity among Leafs fans vs. Flames fans is because there are two tenants at the Scotiabank arena in Toronto: The Maple Leafs and lone Canadian NBA team, Toronto Raptors. In theory, people may not associate Scotiabank specifically with the Leafs, but more so with the Raptors or the Arena itself. This is in comparison to the Flames being the only Big 5 tenant of the Scotiabank Saddledome (which is also the skyline defining mark of Calgary).

Another reason Calgary is performing better may be due to the size of the market in Toronto, which is saturated with sponsorships and marketing, due to housing all 5 major sports. Calgary, on the other hand, is home to only 2 of the major sports: hockey (Flames) and football (Stampeders).

In Conclusion

Most NHL naming rights partnerships are producing good results, but there are some which do not seem to be working well. This is why it is crucial to analyze the data to find the right partner, so both parties will have a long-lasting partnership that is beneficial to both the team and sponsor alike.

Sources

A special thank you to Zoomph for allowing us to use their platform to collect this data.

- https://zoomph.com

- https://docs.google.com/spreadsheets/d/e/2PACX-1vTHVO3Atw00fqzKorlG5KAxSv4GlBSwsiV1ibOZy8qha_m9EUelm_pxSJJ5c02qkQz0O1KxWaZ7l10a/pubhtml

- Photo Credit, “NHL Predators”: Marshal Smith

About the Author

Marshal W. Smith graduated from Samford University in December of 2021 and plans to pursue his master’s here at Samford once his diagnosis of Crohn’s disease/Ulcerative Colitis is in remission. He plans to work with a major sports franchise in marketing or data analytics. Here is a link to his LinkedIn profile: www.linkedin.com/in/marshalwsmith