It's 6:45 AM on a Saturday in Chicago, and 22-year-old Alex Taylor is already awake, phone in hand, planning his soccer viewing marathon through the Live Soccer TV app. The app displays over 100 international leagues with detailed kickoff times and streaming information for each match. With multiple screens ready—laptop, TV, and tablet—Alex prepares to watch several games simultaneously throughout his 14-hour soccer day.

His morning begins with Premier League action as Chelsea faces Liverpool at 6:30 AM. He's particularly excited to watch Egyptian star Mohamed Salah lead Liverpool's attack. On his second screen, he keeps tabs on AC Milan in Italy's Serie A, where U.S. star Christian Pulisic has been a standout performer since his transfer from Chelsea. By noon, Premier League matches are still ongoing, so he decides to see how midfielder Tyler Adams is playing for AFC Bournemouth. Later, he'll tune into Serie A to see Yunus Musah playing for AC Milan, before finishing his day with late matches from MLS. Sunday will bring a similar routine, with the addition of Liga MX matches from Mexico, a game from the Bundesliga in Germany and perhaps a few games from South American leagues.

Alex's weekend routine, increasingly common among American soccer fans, represents a viewing experience unlike any other in American sports. No NFL or NBA fan can watch elite competition for 12+ hours a day across multiple days. This uniquely immersive experience—facilitated by streaming services like Peacock (Premier League), ESPN+ (LaLiga, Bundesliga), Paramount+ (Serie A, Champions League), and others—has helped drive a remarkable 60% growth in international soccer viewership in the United States since 2018.

As the U.S. prepares to host the 2026 FIFA World Cup alongside Canada and Mexico, new data from SBRnet reveals significant shifts in how Americans engage with the world's most popular sport—changes that could reshape the sporting landscape as North America welcomes soccer's global showcase.

International Soccer Viewership in America: A Growth Story

The total number of Americans who watched non-USA soccer matches increased from 31,409,000 in 2018 to 50,347,000 in 2024—a remarkable 60% growth in just six years. Unlike traditional American sports dominated by a single domestic league, soccer offers American fans a unique opportunity to engage with multiple competitions simultaneously, with many viewers following several leagues throughout the year. This creates an unprecedented viewing experience not available to fans of any other major sport.

5 Key Trends in International Soccer Viewership

-

English Premier League dominates, but fans are diversifying their viewing habits

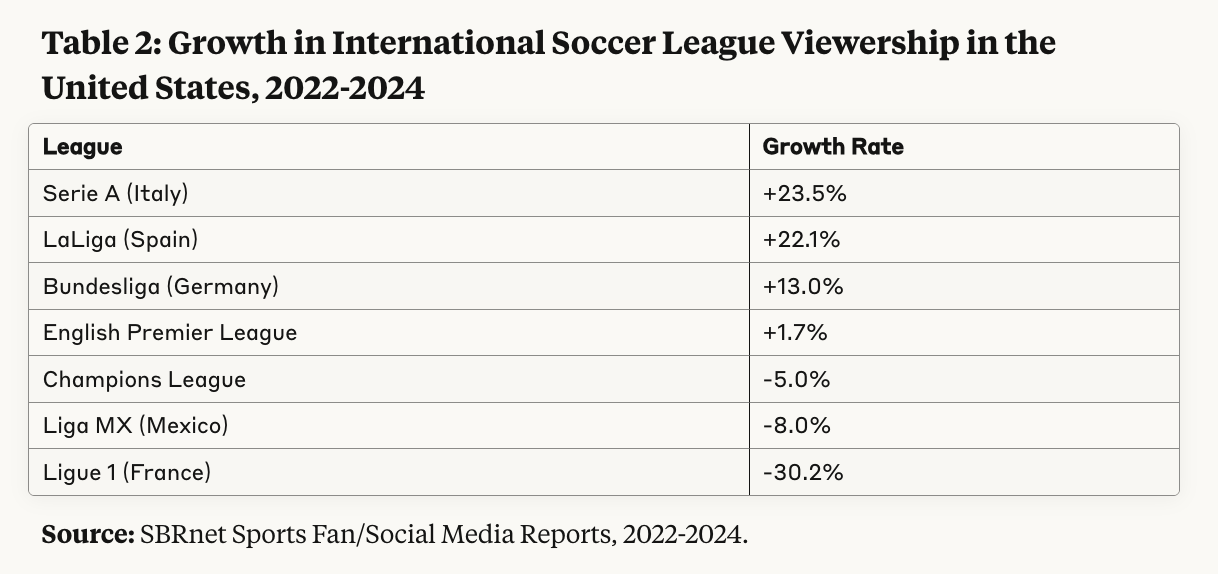

As can be seen in Table 1, the English Premier League remains the most-watched international soccer competition in America, with 36.2 million viewers (72.0% of total international soccer viewership) in 2024. What's particularly notable is that while in previous years fans might have exclusively followed the EPL, today's American soccer enthusiast is increasingly watching multiple leagues simultaneously.

The substantial viewership for Champions League (21.8 million) demonstrates how tournament competitions now command significant attention alongside traditional league play. This suggests American fans are developing a more European-style viewing pattern, where the pursuit of continental glory often eclipses domestic competition in importance. The significant gap between LaLiga (13.7 million) and Liga MX (9.2 million) shows how Spain's top division has successfully captured American audiences despite Mexico's proximity advantage and cultural connections.

The Bundesliga's 8.6 million viewers shows it maintaining a dedicated American audience despite being less marketed than other European leagues, with its viewership likely bolstered by the growing contingent of American players developing in Germany. Beyond stars like Gio Reyna and Joe Scally, the league features Americans such as John Tolkin (Holstein Kiel), Cole Campbell (Borussia Dortmund), Timothy Chandler (Eintracht Frankfurt), Lennard Maloney (Mainz), Kevin Paredes (Wolfsburg), and James Sands (FC St. Pauli). The Bundesliga has become particularly attractive for young American talent because, as former Hannover star Steve Cherundolo noted, it's "the youngest of the top five leagues in Europe" where players "get real opportunities to start games" rather than limited minutes. This player development pipeline, combined with easier work permit requirements than in England, has created a virtuous cycle where American viewers increasingly follow the Bundesliga to watch their compatriots, further strengthening the league's U.S. viewership numbers.

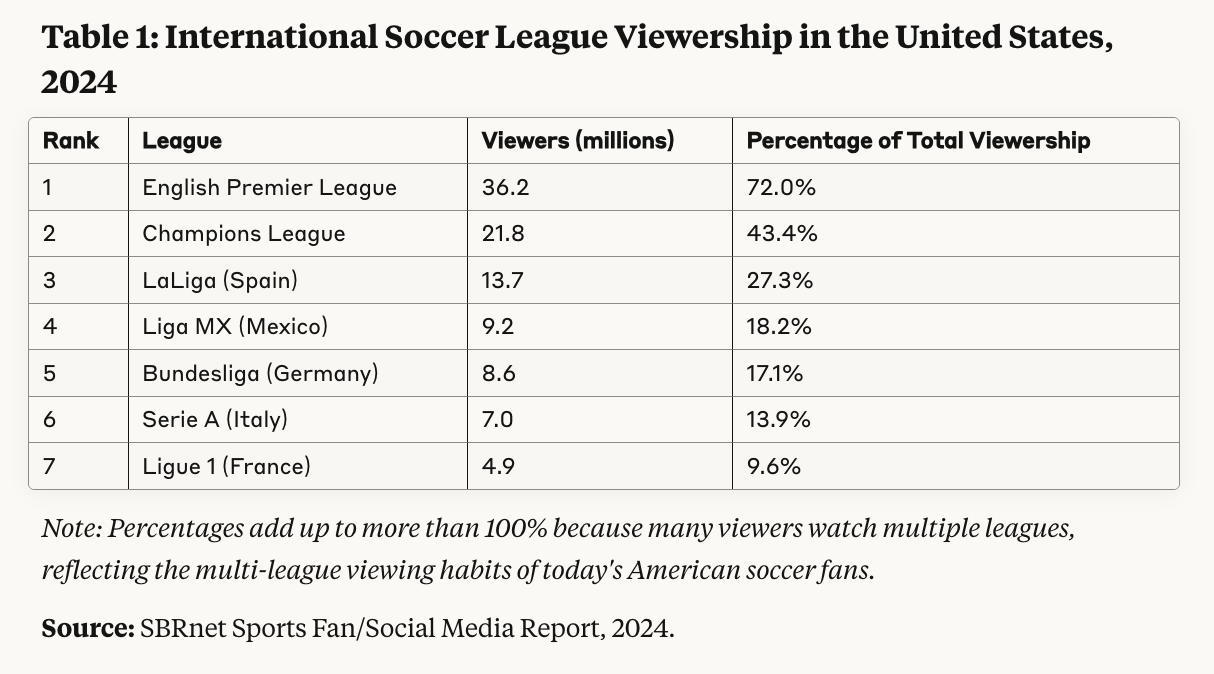

Table 2 reveals a fascinating evolution in American soccer fandom that challenges conventional assumptions about which leagues are gaining traction.

The standout story is Serie A's remarkable +23.5% growth rate, suggesting that CBS/Paramount+'s innovative broadcasting approach—combining serious tactical analysis with approachable presentation—is resonating strongly with American audiences. This Italian soccer renaissance is particularly noteworthy considering Serie A's diminished global prominence since its 1990s heyday. LaLiga's impressive +22.1% growth rate indicates Spain's top division is successfully expanding its American footprint despite broadcasting transitions, with star power and the technical quality of play clearly attracting new viewers.

The Bundesliga's solid +13.0% growth reflects Germany's consistent focus on accessibility, youth development, and the growing contingent of American players in the league. The Premier League's modest +1.7% growth suggests it may be approaching market saturation after years as the entry point for American soccer fans, though it maintains its dominant overall position as seen in Table 1.

Perhaps most surprising are the negative growth rates for Champions League (-5.0%), Liga MX (-8.0%), and especially Ligue 1 (-30.2%). The Champions League decline challenges the assumption that knockout tournaments naturally appeal to American sports fans, possibly indicating broadcasting or scheduling issues. Liga MX's decline despite its cultural connections and proximity advantage suggests competition from European leagues is intensifying within Hispanic American communities. Ligue 1's dramatic -30.2% drop represents a serious concern for French soccer's American strategy, potentially reflecting both broadcasting challenges and competitive limitations beyond PSG. These contrasting trajectories indicate American viewers are becoming increasingly discerning about the specific product they consume rather than simply watching any available soccer content.

The viewing patterns revealed in Tables 1 and 2 have profound implications for the 2026 World Cup. The EPL's dominance yet modest growth suggests a maturation of the American soccer market, while the impressive growth of Serie A and LaLiga indicates increasing sophistication among viewers who appreciate different playing styles. This evolving landscape means World Cup organizers should anticipate American fans coming with highly developed soccer literacy and expectations for quality broadcasts that balance tactical analysis with accessible presentation. The Bundesliga's solid growth, fueled partly by American player development, may translate to stronger attendance for Germany's matches and teams featuring Bundesliga stars. Meanwhile, the decline in Liga MX viewership despite cultural connections suggests tournament organizers shouldn't rely solely on ethnic heritage to drive ticket sales but must emphasize the distinctive quality and styles of participating nations. European teams from leagues showing growth (Italy, Spain, Germany) may draw unexpectedly strong American support beyond diaspora communities, while teams from France might need additional marketing efforts to counter Ligue 1's viewership decline. These trends collectively portend a World Cup audience unlike any previous tournament—more diverse, more knowledgeable, and more selective in their viewing choices—creating an opportunity for 2026 to be a watershed moment in American soccer history if properly leveraged.

-

Distinct regional viewership patterns

The regional distribution of international soccer viewership across the United States reveals fascinating geographic patterns that go beyond simple population density explanations. These regional trends offer critical insights for World Cup 2026 planners, broadcasters, and marketers.

- South Atlantic region (11.5 million viewers): Florida, Georgia, the Carolinas, Virginia, Maryland, DC, Delaware, and West Virginia show the highest concentration of soccer fans across most leagues.

- Pacific region (12.6 million viewers): California, Oregon, Washington, Alaska, and Hawaii demonstrate particularly strong viewership for Liga MX, reflecting large Hispanic populations in these states.

- West South Central region (15.7 million viewers): Texas, Oklahoma, Arkansas, and Louisiana represent the fastest-growing region for soccer viewership, with extraordinary growth rates for LaLiga (+120.8%), Serie A (+82.6%), and Champions League (+69.5%).

South Atlantic Region: The Soccer Heartland

41% of all soccer fans (20,443,000) that watched or attended a non-U.S. soccer match in 2024 lived in the southern part of the United States. In the South, the South Atlantic region’s 11.5 million viewers across Florida, Georgia, the Carolinas, Virginia, Maryland, DC, Delaware, and West Virginia represents the highest concentration of soccer fans across most leagues. This region has emerged as a true soccer stronghold for several compelling reasons.

The demographic diversity throughout this region helps explain its soccer enthusiasm. Florida's large Caribbean and South American populations bring deep-rooted soccer traditions, while the Mid-Atlantic states have seen significant immigration from soccer-passionate regions of Africa and Central America. Additionally, the region contains several major MLS markets (Atlanta, Miami, DC, Charlotte) that have helped cultivate soccer culture.

Atlanta's emergence as a soccer powerhouse is particularly noteworthy, with Atlanta United consistently leading MLS attendance figures. This strong regional foundation suggests World Cup matches in Atlanta and Miami will likely see exceptional ticket demand, especially for games featuring South American nations whose leagues have growing viewership in this region.

Pacific Region: A Liga MX Stronghold with Diverse Appetites

The Pacific region's 12.6 million viewers across California, Oregon, Washington, Alaska, and Hawaii show particularly strong viewership for Liga MX, reflecting large Hispanic populations in these states. However, this analysis can be expanded to recognize the region's multifaceted soccer landscape.

The Pacific region demonstrates remarkable league diversity in its viewership patterns. While Liga MX dominates in Southern California and parts of the Pacific Northwest with large Mexican-American communities, the Premier League enjoys substantial followings in the tech corridors of Seattle and the Bay Area. Meanwhile, the Korean and Japanese populations in these states drive viewership of K-League and J-League matches rarely watched in other U.S. regions.

The SoFi Stadium in Inglewood along with Levi's Stadium in Santa Clara and Lumen Field in Seattle, are positioned to leverage this regional passion. Matches featuring Mexico will undoubtedly create electric atmospheres, but the region's diverse soccer interests suggest strong attendance across a wide range of participating nations.

West South Central Region: The Fastest-Growing Soccer Market

The West South Central region comprising Texas, Oklahoma, Arkansas, and Louisiana represents the fastest-growing region for soccer viewership, with extraordinary growth rates for LaLiga (+120.8%), Serie A (+82.6%), and Champions League (+69.5%). Several factors may explain this remarkable acceleration.

Texas stands as the region's soccer epicenter, with Houston and Dallas both hosting thriving MLS franchises and strong multicultural populations. The state's proximity to Mexico naturally drives Liga MX viewership, but the dramatic growth in European league viewership suggests deepening soccer sophistication beyond traditional cultural affiliations.

Economic factors may also play a role in this regional surge. Texas's strong economy and growing international business connections have brought an influx of European and South American professionals familiar with these leagues. Meanwhile, younger demographics in the region appear increasingly drawn to soccer's global nature, with college campuses becoming hotbeds for watch parties featuring Champions League matches.

The AT&T Stadium in Arlington (Dallas) and NRG Stadium in Houston will both host World Cup matches, perfectly positioned to capitalize on this region's soccer boom. The data suggests these venues could see particularly strong demand for matches featuring Spain, Italy, and European powerhouses, beyond the expected enthusiasm for Mexican national team games.

-

Rapidly diversifying audience

Figure 1 reveals striking differences in ethnic viewership patterns across international soccer leagues, with each competition developing a distinctive audience profile. Liga MX shows the strongest Hispanic viewership concentration, with approximately 66% of its audience coming from Hispanic communities, reflecting cultural affinity and language accessibility. In sharp contrast, the Bundesliga exhibits the highest proportion of Caucasian viewers among all leagues, suggesting its marketing and broadcasting approach may resonate particularly well with this demographic. The Premier League, Champions League, and LaLiga all display relatively similar ethnic distribution patterns, indicating their broad cross-cultural appeal, though with Caucasian viewers forming their largest segment. What's particularly noteworthy is how Serie A and Ligue 1 show distinctive patterns that differ from their European counterparts. Serie A demonstrates a strong balance between Hispanic and Caucasian viewership, suggesting successful penetration into multiple ethnic communities.

Figure 2 provides an overview of the total international soccer audience in the United States, showing Caucasian viewers at 44.6%, Hispanic viewers at 33.1%, and African American and "Other" categories each at approximately 11%. This overall distribution demonstrates that soccer has established significant viewership across all major ethnic groups in America.

For World Cup 2026 organizers, these patterns suggest an opportunity to engage with a diverse American audience through targeted and inclusive marketing strategies that recognize the broad appeal soccer now has across different communities in the United States.

-

Different leagues appeal to different demographic groups

Our analysis reveals that each international league has developed a distinctive audience profile in the U.S.

Age Distribution (2024):

- Ligue 1 (France) has the highest percentage of young viewers (25.8% aged 13-24)

- LaLiga (Spain) (22.2%) and Champions League (18.3%) also have strong youth appeal

- Liga MX (Mexico) has the strongest concentration in the 35-49 bracket (39%)

- Serie A (Italy) (60.7%) and LaLiga (53.8%) also have strong appeal to prime adults

- English Premier League has the oldest overall audience profile, with 34.9% of viewers aged 50+

- Bundesliga (Germany) also skews older with 29.1% of viewers aged 50+

Notable Age Demographic Shifts (2022-2024):

- 25-34 age group increased significantly for Bundesliga (+10.4 percentage points)

- 35-49 age group increased dramatically for Liga MX (+8.8 percentage points)

- 18-24 age group increased most for Ligue 1 (+8.2 percentage points)

- Youth viewers (13-17) decreased most for Bundesliga (-5.0 percentage points)

Ligue 1 from France has established itself as the youth leader with 25.8% of its viewers in the 13-24 age bracket, while LaLiga and Champions League are also building strong foundations with younger audiences. Meanwhile, the Premier League has the most mature audience profile with 34.9% of viewers aged 50+, suggesting it was the entry point for many early American soccer adopters who have maintained their loyalty over time.

Particularly interesting are the demographic shifts between 2022-2024, with the Bundesliga seeing a substantial 10.4 percentage point increase in the 25-34 demographic, potentially reflecting growing interest in young American stars who have established themselves in Germany (read more about this trend earlier in the article). This growth in the millennial audience for German soccer could translate to strong attendance for Germany's matches during the 2026 tournament.

Similarly, the dramatic 8.8 percentage point increase in the 35-49 age group for Liga MX indicates the Mexican league is solidifying its position with established professionals, many of whom may represent the highest-spending demographic for World Cup tickets. Tournament organizers should note that games featuring Mexico are likely to attract not just passionate support but also viewers with significant disposable income.

Ligue 1's 8.2 percentage point increase in the 18-24 demographic suggests French clubs are successfully connecting with college-age Americans, perhaps through social media strategies or the appeal of stars like Kylian Mbappé. This could make France's matches particular draws for younger fans during the World Cup.

These age-related viewing patterns also create unique marketing opportunities for World Cup sponsors. Brands targeting younger consumers might focus their activation around nations whose leagues have strong youth appeal (France, Spain), while those seeking to reach older adults with higher discretionary income might emphasize teams from leagues with more mature audiences (England, Germany).

For host cities, understanding these age demographics could influence event planning around matches. Cities hosting games featuring teams from leagues with younger audiences might emphasize festival atmospheres and digital engagement, while those hosting teams with older fan bases might focus on premium experiences and traditional hospitality.

-

Growing female viewership

The female viewership data from 2022 to 2024 reveals additional important trends for international soccer in America:

Female Viewership by League (2024):

- Liga MX has the highest female viewership at 42.0%

- LaLiga has 37.4% female viewers

- Ligue 1 has 33.0% female viewers

- English Premier League has 30.2% female viewers

- Champions League has 29.9% female viewers

- Serie A has 28.9% female viewers

- Bundesliga has the lowest female viewership at 26.1%

Notable Gender Trends (2022-2024):

- Female viewership percentage increased most for Bundesliga (+4.6 percentage points) and Liga MX (+3.0 percentage points)

- Female viewership percentage decreased most for Serie A (-3.8 percentage points) and Ligue 1 (-3.2 percentage points)

Commentary on Growing Female Viewership in International Soccer

The remarkable growth in female viewership across international soccer leagues represents a transformative shift in the American sports landscape with significant implications for the 2026 World Cup. Liga MX's industry-leading 42.0% female viewership shatters outdated perceptions of soccer as a predominantly male-oriented sport, suggesting that content authenticity and cultural relevance may be more effective in attracting female audiences than traditionally gendered marketing approaches. The impressive female viewership for LaLiga (37.4%) and Ligue 1 (33.0%) indicates European soccer's growing cross-gender appeal, while the Premier League (30.2%) and Champions League (29.9%) show solid but perhaps underperforming female engagement given their overall market dominance.

The contrasting growth trajectories between 2022-2024 tell an equally compelling story. The Bundesliga's industry-leading 4.6 percentage point increase suggests its focus on family-friendly stadium experiences, accessible broadcast content, and community engagement resonates particularly well with female viewers. Similarly, Liga MX's 3.0 percentage point growth indicates that leagues with already strong female viewership can still drive further expansion through deliberate outreach. Conversely, the concerning declines for Serie A (-3.8 percentage points) and Ligue 1 (-3.2 percentage points) highlight that female viewership isn't guaranteed to increase organically and may require specific strategies to maintain and grow.

For 2026 World Cup organizers, these trends suggest several strategic imperatives. First, the tournament should reject outdated binary marketing approaches that segregate "core fans" from "casual" or female viewers, instead recognizing women as essential, knowledgeable participants in soccer culture. Venue facilities, merchandise offerings, and public spaces should be designed with gender-inclusive considerations from the outset, not as afterthoughts. Media training for commentators and presenters should emphasize avoiding patronizing or simplistic coverage that might alienate the sophisticated female audience these numbers reveal. Most importantly, ticket package strategies should recognize that today's female soccer fans represent not just "plus-ones" but autonomous, dedicated viewership segments with distinct preferences and engagement patterns.

The tournament arrives at a pivotal moment when women's and men's soccer are increasingly converging in public consciousness, with the highly successful 2023 Women's World Cup and growing professional women's leagues setting new expectations. World Cup organizers who successfully leverage these female viewership trends could establish new benchmarks for gender-inclusive major sporting events, creating long-term positive impacts on soccer's cultural positioning in America. By embracing rather than underestimating the female audience revealed in this data, the 2026 World Cup has an unprecedented opportunity to redefine sports event accessibility and engagement across gender boundaries.

The Role of Domestic Soccer: A Symbiotic Relationship

While international soccer viewership has grown dramatically across diverse demographic segments, Major League Soccer has simultaneously established itself as a cornerstone of the American sports landscape. The parallel rise of MLS—from 30,627,000 viewers in 2018 to 48,164,000 in 2024, representing a 57% increase—creates a fascinating symbiotic relationship between domestic and international soccer consumption that's unique in American sports culture.

MLS has undergone a remarkable transformation from its humble 10-team beginnings in 1996 to today's robust 30-club competition spanning the United States and Canada. The league's 2024 attendance record of over 11.4 million fans attending regular-season matches (a 5% increase from 2023 and a 14% jump from 2022) reflects growing in-person engagement that complements digital viewership. This steady growth trajectory suggests MLS has established sustainable fan communities in diverse markets rather than experiencing the boom-and-bust cycles that plagued earlier American soccer leagues.

What makes soccer unique in the American sports ecosystem is the complementary rather than competitive relationship between domestic and international viewership. While NFL fans rarely follow European football leagues or NBA enthusiasts seldom watch European basketball, soccer presents a model where many American fans maintain dual loyalties—following both MLS and international competitions simultaneously. This creates distinctive viewing patterns where engagement with one soccer property often strengthens rather than cannibalizes interest in others.

For the 2026 World Cup, this distinctive fandom ecosystem presents unprecedented opportunities. Host cities with established MLS franchises like Atlanta, Seattle, and Los Angeles offer built-in soccer infrastructure, established fan cultures, and experienced event operations teams. MLS stadiums will serve as crucial training facilities for visiting nations, while MLS supporters' groups provide models for creating authentic match-day atmospheres. The tournament also offers MLS a global showcase, potentially attracting international fans and players who might previously have overlooked American domestic soccer.

The demographic trends observed in international soccer viewership—increasing diversity, growing female engagement, and multi-league consumption—are mirrored in MLS's own evolution. The league has increasingly embraced accessibility initiatives, multicultural marketing, and gender-inclusive fan experiences. These parallels create natural pathways for World Cup organizers to leverage MLS's community connections while helping the domestic league benefit from the tournament's global spotlight.

Digital content and social media engagement represent another area where domestic and international soccer interests reinforce each other. American fans comfortable navigating MLS's digital ecosystem may more easily engage with World Cup content, while international soccer's sophisticated digital presentation sets standards that elevate domestic coverage. This cross-pollination of viewing technologies, statistical approaches, and narrative storytelling benefits both domains.

As the World Cup approaches, MLS clubs will likely play critical roles in local organizing efforts, fan engagement initiatives, and community legacy programs. Unlike temporary event structures created solely for the tournament, MLS provides permanent institutional frameworks that can extend the World Cup's impact beyond the competition itself. This integration of domestic and international soccer interests positions the 2026 World Cup not merely as a global mega-event hosted on American soil, but as the culmination of decades of soccer development within the United States itself.

Conclusion: A True Watershed Moment for American Soccer

The 2026 World Cup arrives at what is unquestionably a watershed moment for soccer in America, with converging data trends demonstrating the sport has reached critical mass across multiple dimensions of the American sports ecosystem. The dramatic 60% growth in international soccer viewership since 2018—from 31.4 million to over 50.3 million Americans—represents an unprecedented rate of adoption that far outpaces other major sports' growth during comparable periods. This sustained viewership explosion is particularly remarkable when contextualized alongside MLS's simultaneous 57% audience growth and 14% attendance surge since 2022.

What makes this moment truly transformative is the comprehensive nature of soccer's penetration across previously resistant demographic segments. The data reveals soccer has systematically dismantled its traditional barriers to mainstream American adoption: it has achieved significant viewership among older Americans (34.9% of Premier League viewers are 50+), made remarkable inroads with female audiences (Liga MX achieving industry-leading 42% female viewership), established strong followings across diverse ethnic communities (with significant viewership growth among Caucasian, Hispanic, African American and other demographic groups), and expanded beyond coastal urban centers into the previously untapped West South Central region.

The unique "league diversification" phenomenon—where American fans simultaneously follow multiple international competitions rather than just one—demonstrates a level of engagement depth unprecedented in American sports culture. While the EPL remains dominant with 36.2 million viewers, the substantial audiences for Champions League (21.8 million), LaLiga (13.7 million), Liga MX (9.2 million), and other leagues reveal how American fans have developed sophisticated soccer palates that appreciate varying styles and competitions. This multi-league consumption creates an immersive viewing experience unavailable to fans of any other sport, with the average dedicated fan now consuming over 12 hours of soccer content weekly across multiple platforms.

The domestic-international symbiosis reflected in the parallel growth of both international league viewership and MLS attendance establishes a self-reinforcing ecosystem that insulates soccer from the boom-bust cycles that plagued previous attempts to establish the sport in America. This creates sustainable growth fundamentals unlike any previous period in American soccer history.

For World Cup organizers, broadcasters, and stakeholders, these converging data trends offer compelling evidence that 2026 will mark the definitive transition of soccer from an emerging niche to a permanent cornerstone of American sports culture. The tournament doesn't merely arrive at a favorable moment for soccer in America—it represents the culmination of decades of grassroots development, demographic shifts, technological innovations, and cultural evolution that have fundamentally reshaped how Americans engage with the world's game. When the first match kicks off in 2026, it won't just be the beginning of a tournament; it will be the coronation of soccer as a fully integrated element of American sports identity.

Methodology

The data in this article is based on SBRnet's proprietary Sports Fan Survey, a comprehensive annual consumer research initiative conducted since 2017. The most recent survey was fielded online in January 2024 among a nationally representative panel of 7,064 U.S. consumers aged 13 and older. The study employed a rigorous probability-based sampling methodology to ensure demographic representation across age, gender, income, ethnicity, and geographic regions.

Each respondent reported on their attendance and viewership patterns for professional, college, and minor league sports, along with 68 other categories of fandom-related metrics. The survey captured detailed information about sports media consumption across multiple platforms, participation in fantasy sports and sports betting, social media engagement patterns, favorite teams, sports tourism behavior, and comprehensive demographic indicators.

To ensure national representativeness, the data was weighted and balanced to align with the demographic composition of U.S. households based on geographic region (using U.S. Census Bureau definitions), income, household size, age, gender, race, and ethnicity. The findings were then projected to represent the U.S. population of 282.5 million people aged 13 or older.

For data analysis, we employed a multi-stage analytical approach with computational assistance from Claude AI to identify the five key trends presented in this article and explore their potential implications for World Cup 2026. Utilizing advanced pattern recognition and statistical correlation techniques, the analysis identified significant shifts in viewing patterns across leagues, demographic segments, and geographical regions. All findings, interpretations, and conclusions were subsequently verified and validated by the human author to ensure accuracy and contextual relevance before publication. This collaborative methodology represents emerging best practices for data-intensive research, where AI tools augment human analysis while maintaining rigorous fact-checking protocols and subject matter expertise.

For comparative trends in international soccer viewership, we supplemented our primary research with industry data from reputable sources including the Boston Consulting Group's "Economic Impact Analysis of 2026 FIFA World Cup" (2023), Major League Soccer's Annual Report (2024), and the Pew Research Center's "American Sports Engagement Survey" (2023-2025).

Sources

- SBRnet Sports Fandom Survey, 2018-2024

- Boston Consulting Group, "Economic Impact Analysis of 2026 FIFA World Cup," 2023

- Major League Soccer, "Annual Report," 2024

- Pew Research Center, "American Sports Engagement Survey," 2023-2025

- Sports Innovation Lab & Jung von Matt SPORTS, "Fanarchy26 Report," 2023

- SGB Media, "Study: U.S. Fan Interest In Soccer Growing," 2023